This requires you to definitely additional fund getting placed to help you balance the brand new losing status. Leverage can be enhance gains with CFDs but influence can also magnify losses. A binding agreement to own Difference (CFD) means an advanced financial by-product used by traders to take a position to your short-label speed moves of several root tools. Agreements are executed within the bucks as there isn’t any replace out of bodily goods otherwise bonds. Control allows you to decrease the size of their put and you can make use of your money more effectively. Control trading involves using the money into your broker membership because the a deposit, known as margin, so you simply create a percentage of the rates of getting a situation.

Investigating CFD Change Programs

People with this particular method might require strong and you may brief decision-and make feel due to the rate where something’s price can also be flow whenever reports and financial analysis try put-out. Listed here are intricate definitions away from nine popular CFD trading tips. Although not, for every part the market industry actions up against her or him, they will build a loss of profits.

- CFDs had been created on the 90s as a means from allowing investors to access the fresh places far more taxation effectively.

- However, whenever change CFDs having power, you will need to keep in mind one losses because the well since the payouts was computed with regards to the overall dimensions of the reputation, rather than the main city invested.

- The brand new bargain is made ranging from an investor and, constantly, either a-spread betting corporation otherwise an investment financial.

- You could potentially cash in on one another rising and you can dropping places from the trade the cost difference between your entryway and you may get off points.

- Inside the CFD trade, knowledgeable participants believe in investigation, maps, economic symptoms, and you can chance administration systems to tell the steps.

Finishes and limits are crucial exposure administration products readily available for most buyers. You can even imagine secured end-losses, which provide greater defense much more unpredictable places, as well as wanted a charge to make use of. Very CFD deals have no fixed expiry day, which means CFD offer duration try endless. There is certainly an additional charge away from an instantly investment changes, that is removed if a swap is kept unlock right away. The main CFD areas which have an enthusiastic expiry time are futures and you can alternatives. Although not, straight away money charges will be incurred if the spot ranking are left open immediately after 10pm British day (global minutes can vary).

Because the CFD change is performed because of control, you can eliminate over the original margin number required to unlock a swap. For the reason that having influence, winnings and you can losses try determined in accordance with the full property value the brand new change, not just the newest margin matter. Such, if you were to think GBP/JPY is just about to belong rate, you’ll promote a CFD to your GBP/JPY. You’ll nevertheless exchange the difference in cost between in case your reputation are open just in case it is signed but tend to earn a good funds in the event the GBP/JPY falls in cost and you may a loss when the GBP/JPY expands in cost.

Just before committing, it’s also advisable to consider recommendations, make sure the brand new agent’s regulating history, and you can determine customer support. Play with a demonstration membership to check the process ahead of getting actual money on the https://taurona.com/en/ line. Allowing you can be aware of the exchange system and you will hone their means without worrying regarding the losing profits. To attenuate you’ll be able to losings, play with chance management procedure such stop-losings requests. Think about the prospective risks of for every trading, rather than save money than just you really can afford to shed.

- So, as you can be copy a classic change you to definitely winnings because the a field rises in expense, you can also open a good CFD status that may money as the the underlying market decreases in expense.

- We offer a totally free demonstration account to any or all people seeking teaching its positions ahead of opening an alive membership.

- Playing with leverage requires a high number of involvement, as it is advisable to monitor your own positions frequently.

- Greater quote-inquire advances will often appear at the a broker throughout the punctual segments that may obstruct and increase the purchase price involved in your CFD exchange entries and you may exits.

Trade margins can be as low because the step 1%, when you get a posture really worth $20,one hundred thousand, it may only require a good $200 deposit – that is not a lot of to possess an armchair trader. Some CFDs follow an expiration calendar such as futures agreements, when you’re other CFDs wear’t end but are folded right away (subject to a finance costs for the leveraged amount of the newest position). Contracts to possess differences (commonly referred to as CFDs) is actually leveraged by-product products which particularly song the value of an enthusiastic root advantage.

Funding.com will bring negative harmony security (NBP) to own CFD accounts. In the event the after margin close-out what you owe drops to your negative, the fresh NBP procedure brings your bank account returning to zero. It is possible to monitor spaces to the system and you may romantic him or her when you wish. We do not aim to profit if the a person manages to lose, and you can the business structure will be based upon delivering a good feel to investors. Say, such, you pick 5 deals when the investment purchase pricing is 7500.

How Margin Functions: A mathematical Analogy

One which just discover a managed CFD broker, you need to understand what types of requests are for sale to derivatives and in case it is compatible to utilize her or him. For every order kind of has its own distinctive features and you will serves another objective. Inside area, we temporarily explanation half a dozen of the most preferred purchase types your can also be apply whenever trading contracts to own distinction. CFD change discusses a standard set of assets such as brings and you may products, if you are this market focuses solely to your money sets. With time, the purchase price in the market increases to help you $15, therefore decide to personal the fresh bargain from the attempting to sell.

Biggest currency sets often have higher control than simply exotic currency pairs, which have large volatility minimizing exchange quantities. Trade merchandise in the CFDs enable it to be investors when deciding to take benefit of price motions driven by the geopolitical incidents, weather, likewise have disruptions, and you may alterations in demand. Having usage of a wide range of products, buyers can also be use various tips and you can funds round the various other sectors. Forex is actually a top liquidity field, and this assures tight advances and rapid buy execution.

Brokers will require a federal government-given document to pass through the new verification techniques. Along with, you may have to give evidence of address, which is done-by publishing a bank declaration, electricity, or cellular phone bill. FXCess doesn’t give the features so you can owners out of specific jurisdictions for example Us, Iran, Cuba, Sudan, Syria and you may Northern Korea. Analytics or past performance isn’t a vow into the future results of your own sort of unit you are looking at. All this and in case there had been no costs for financing the newest oils, shop, transport, etc. This is because it is banned by Us Ties and you can Exchange Fee.

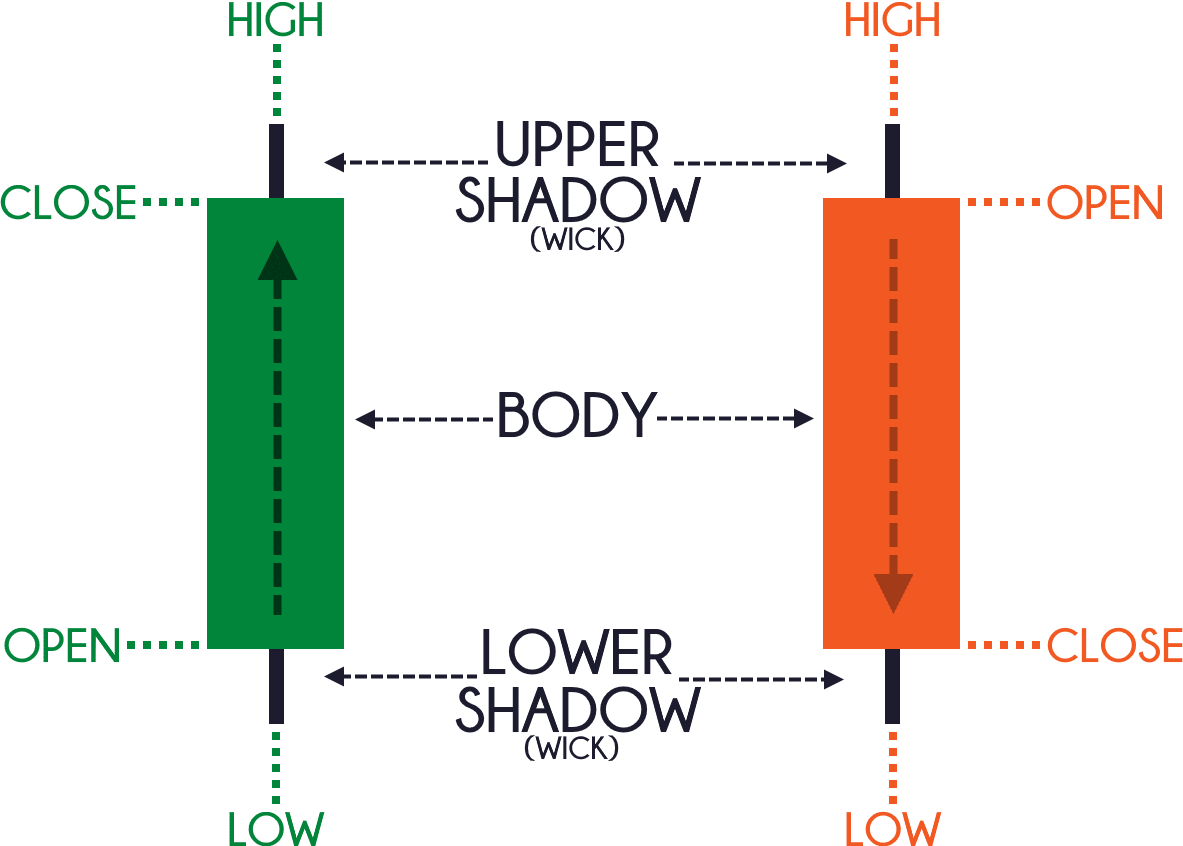

The fresh ask (buy) rates remain slightly higher than the brand new bid (sell) rates. The essential difference between both of these costs is what’s known as the spread. The new people can get question how it is possible to possess forex traders to purchase otherwise promote currencies they wear’t own. An industry path from 0.5% facing your situation, originally appreciated in the £ten,100000, do cause a great 50% (£50) losings against their transferred margin.

Secret Principles from Graph Study

Whether CFDs are better than forex hinges on your trade desires and you may choices. CFDs render a lot more liberty, enabling you to trading on the a variety of property, while forex concentrates only for the money pairs. CFDs may additionally offer much more control and independency, but they come with high dangers because of market volatility.

CFDs will likely be traded for the several programs and provide smoother availability to help you worldwide segments. That it access to allows investors to react punctual to market motions and you can execute trades efficiently. Closure the positioning finalises the new trade, and the money otherwise losings is calculated according to the change amongst the beginning and closure costs, increased because of the position proportions. CFD agents such as PU Perfect render access to exchange platforms one to ensure it is pages so you can analyse locations, lay orders, and you will create chance. Most CFD agents charges a-spread — the difference between the new buy (ask) rate and also the sell (bid) price.